Indian Drone Industry: Empowering India's sky

A deep dive into trends, opportunities and challenges of drone industry

While studying at my alma mater, I encountered a tech group called ARK (Aerial Robotics Kharagpur), which specialized in creating impressive drones and aerial vehicles. This sparked my curiosity and led me to delve deeper into the fascinating world of drones.

Initially developed for military purposes, drones have transcended their original applications and are now making a significant impact across various sectors, much like microwaves, computers, GPS, and the Internet.

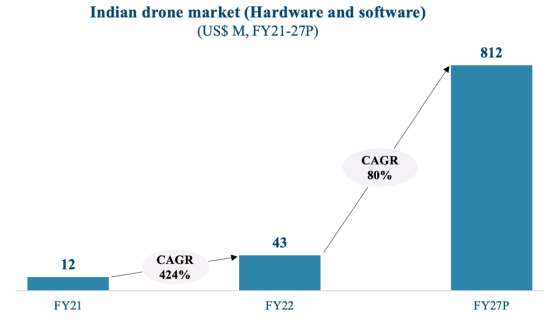

Drones, also known as unmanned aerial vehicles (UAVs), are equipped with sensors and can be controlled remotely or autonomously. They are capable of flying and performing a range of tasks such as surveillance, monitoring, and delivery.Recognizing the potential of drones, the Indian Government introduced a 'Drone Policy' in 2021 and a PLI scheme for drone manufacturers with the goal of establishing India as the global hub for drones. The drone manufacturing industry's annual sales turnover is expected to grow from US$ 8 million in FY21 to over ~US$ 110 million in FY24.

Source: 1Lattice report on Indian Drones1

Furthermore, the global recognition of non-Chinese manufactured drones has increased due to their role in events like the Russia-Ukraine wars. This positions India favorably to become a major global player in the drone industry.

Currently, drones are primarily used in five areas:

Military Applications: The largest use-case currently, with 80-90% of Indian-manufactured drones sold to the defense sector.

Industrial Use-Cases: The second largest use-case, with drones being employed by large enterprises in sectors such as oil & gas and mining for mapping, surveying, and industrial monitoring.

Delivery: Drone delivery is anticipated to be a major driving force in the growth of the drone sector, potentially becoming the largest market segment by 2030. However, challenges such as policy ambiguity, potential impact on gig-workers, safety concerns, and limited payload capacity need to be addressed.

Agriculture: Drones are experiencing rapid growth in agricultural applications, including precision agriculture, spraying, and crop monitoring.

Recreational Use: Currently a niche and hobby market, recreational drone usage involves activities such as photography and videography.

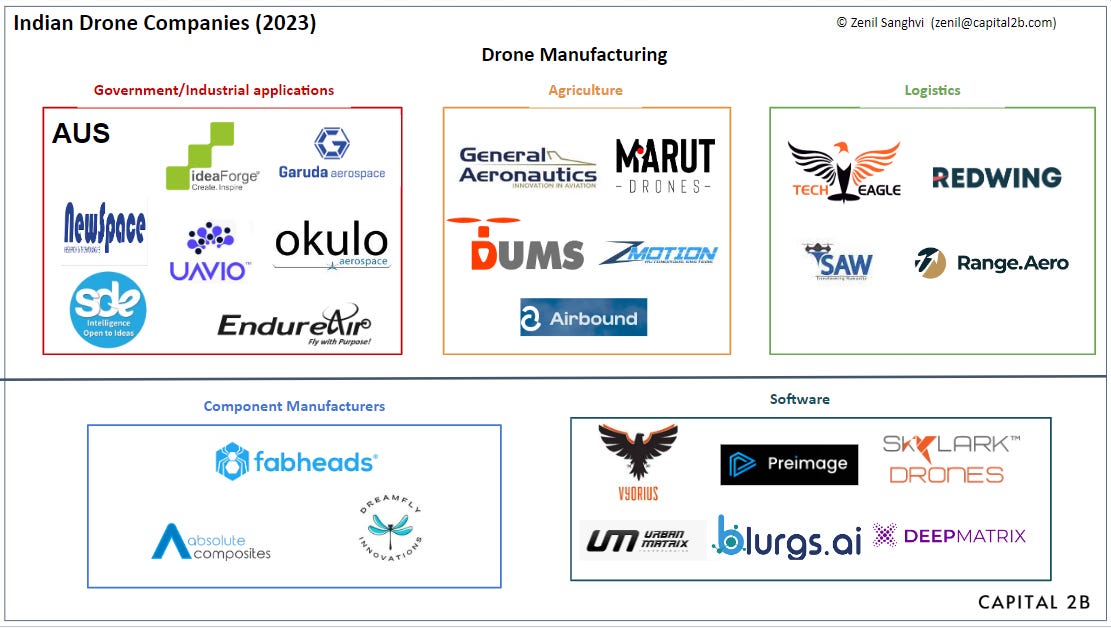

In the 1990s, Indian Army acquired UAVs from Israel which was used as military drones during the 1999 Kargil war for photo surveillance along the Line of Control (LOC).Here is a market-map of Indian startups operating in this space. Currently, the major value in the space have been unlocked by drone manufacturing companies in Government/Defence applications:

To dive further, some of the trends, opportunities, and challenges in the industry are:

Trends

Privatization of Indian defense and increase of drone usage in defence which is triggered by geopolitical events like Russia-Ukraine conflict and Anti-China sentiment with greater reliance on domestic production

Domestic Push: There is a strong push for domestic manufacturing by GoI which can be reflected by PLI scheme, Bharat Drone Mahatsov, the Drone Policy in 2021, and the introduction of ‘Drone Shakti’ in the budget of 2022.

Growth in Enterprise usage: Tech advances from defence-funded R&D have produced more enterprise-ready drone technology. Enterprise usage will continue to be driven by applications in GIS, agriculture, utilities, construction, oil and gas, etc. due to low cost of service, improved operational efficiency, the accuracy of data, and safety.

Opportunities

The rise of the drone manufacturing industry in India will result in significant trickle-down effects across the sub-component value chain, right across materials, batteries, and software solutions.

The drone-as-a-service concept is picking up which can accelerate the slow GTM process.

Once enterprises and the government establish and maintain drone fleets, the market for drone software and services is expected to scale up, potentially surpassing the drone hardware market. Till date, most of the value creation in this industry is unlocked by the hardware players like Ideaforge.

Emerging areas such as Beyond Visual Line of Sight (BVLOS), drone swarms, drone-in-box solutions, and applications like remote sensing of environmental data and firefighting present promising opportunities.

Challenges

The regulations regarding drone delivery are unclear in India and other major markets with a lot of safety, employment, and navigation issues.

The drone industry is still in nascency in India. The market in FY22 was only at $43Mn. Out of this 50%+ market is occupied by Ideaforge. Further, 90% of ideaforge’s revenue comes from defence contracts. So, it represents an opportunity as well as challenge for drone players to navigate the market out there.

Indian defence contracts take up the bulk of revenues (80-90%) for drone companies. In the long run, it would be crucial for these companies and the industry to diversify their revenue base beyond defence use-cases

Currently, most of the value in drone market has been unlocked by the hardware players. The market for drone software and services is still at nascency as there are not enough drones being used by industrial players

The current use cases of mapping, surveying, and inspection are quite limited to the sectors of mining and Oil & Gas. These sectors typically have large, slow-moving enterprises where drone players receive site-wise orders via bidding. So, cracking scalable GTM in this industry is extremely difficult.

As the companies are working with large clients like Government and legacy companies, cash cycles are quite poor and GTM motions are very slow.

Drone safety is still a concern, as are the effects on ecology, security, and privacy.

Overall, there are good tailwinds for Indian drone market with respect to regulations, policies, defence orders, and emerging applications. Once the fleet of drones would be maintained by enterprises, market for drone software and service would also increase. However for this to happen, the industry as a whole needs to move beyond the reliance on government orders, expand their use-cases, evangelize the market and crack the GTM code to sell drones and related software to slow-moving enterprises.

Feel free to DM me on LinkedIn if you have any thoughts on the piece or are working on anything in the space